2024년 6월 18일 원자재 및 경제 관련 이슈와 뉴스들을 정리하는 포스팅 입니다.

6월 18일 (화) 주요일정

경제지표

18:00 유럽 5월 CPI 상승률

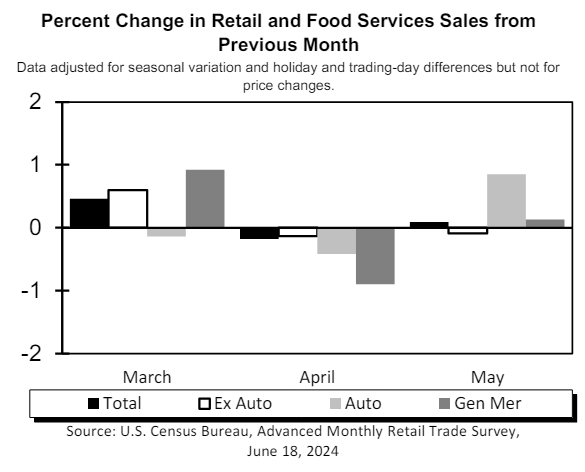

21:30 미국 5월 소매판매

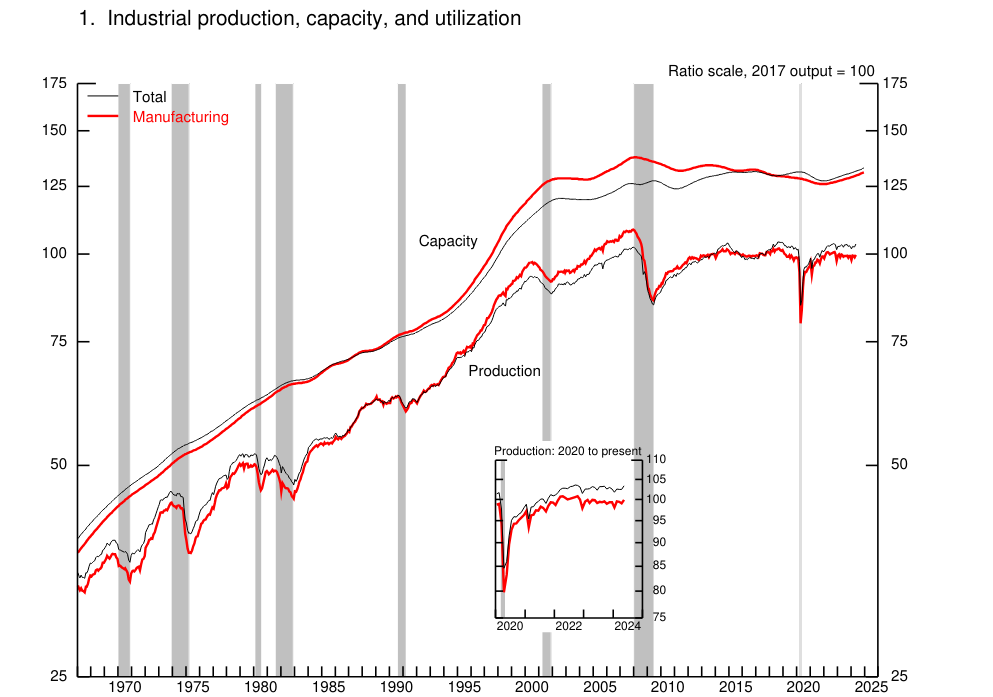

22:15 미국 5월 산업생산, 제조업생산

6월 17일(현지시간)

- 뉴욕증시 : 다우 0.49% ↑ S&P500 0.77% ↑ 나스닥 0.95% ↑

- 미 국채 10년물 금리 : 전거래일 오후 3시 기준보다 6.40bp 오른 4.281%

- 달러화 : 엔화에 강세 유로화에 약세, 달러 지수는 0.147포인트(0.139%) 내린 105.347

◎ 시황요약

- 뉴욕 증시는 인공지능(AI)이 주도하는 흐름이 이어지며 3대 지수 모두 오름

- 테슬라 주가는 일론 머스크에 대한 보상안이 주주들의 투표에서 동의를 얻은 것으로 알려지면서 5%대 오름

- 미국 국채가격은 차익 실현에 따른 매물로 5거래일 만에 하락전환

- 프랑스 정국 우려가 다소 완화된데 힘입어 유로가 반등하자 달러는 하락 압력을 받음

◎ 주요뉴스

07:45 금 가격은 위험 회피와 높은 미국 국채 수익률로 하락

https://www.fxstreet.com/news/gold-price-dives-amid-rising-us-yields-202406171947

Gold price slumps on risk aversion, high US yields

Gold price starts week on back foot as high US yields dent appetite for the non-yielding metal. Fed officials signal only one rate cut in 2024 via Minneapolis Fed's Neel Kashkari. Upcoming US economic data releases, including Retail Sales and Industrial Pr

www.fxstreet.com

08:15 S&P 500, 나스닥 사상 최고치 경신

S&P 500, Nasdaq hit record closing highs ahead of data, Fed comments By Reuters

S&P 500, Nasdaq hit record closing highs ahead of data, Fed comments

www.investing.com

08:30 USD/CAD는 미국 소매판매 발표를 앞두고 1.3750 이하로 하락세를 이어감

USD/CAD extends decline below 1.3750 ahead of US Retail Sales

USD/CAD trades in negative territory near 1.3720 on the softer US Dollar on Tuesday. Fed’s Harker said it is appropriate to keep rates on hold and wait for more data. Higher crude oil prices lift the commodity-linked Loonie and weigh on the pair. T

www.fxstreet.com

08:30 EUR/USD는 시장 심리 회복으로 유로화가 강세를 보이면서 상승세를 보임

https://www.fxstreet.com/news/eur-usd-drifts-higher-as-euro-bolstered-by-recovering-market-sentiment-202406172321

EUR/USD drifts higher as Euro bolstered by recovering market sentiment

As rate cut hopes persist, EUR/USD recovers from a near-term swing low near 1.0670. Investors shrug off cautious Fed tones to bet on September rate cut. EU economic data thin this week with mid-tier events, Friday’s global PMIs loom. EUR/USD recovered to

www.fxstreet.com

10:15 우에다 일본은행 총재는 일본의 임금-물가 사이클이 강화되고 인플레이션이 높아질 것으로 예상

https://www.forexlive.com/centralbank/bank-of-japan-gov-ueda-expects-strengthening-in-japan-wage-price-cycle-higher-inflation-20240618/

Bank of Japan Gov Ueda expects strengthening in Japan wage-price cycle - higher inflation | Forexlive

Bank of Japan Governor Ueda speaking from parliament

www.forexlive.com

10:45 BoJ 우에다: 데이터에 따라 7월 금리인상 가능성

https://www.fxstreet.com/news/bojs-ueda-possible-rate-increase-in-july-depending-on-data-202406180139

BoJ’s Ueda: Possible rate increase in July depending on data

The Bank of Japan (BoJ) Governor Kazuo Ueda said on Tuesday that there is a chance that the Japanese central bank could raise interest rates at the July meeting, depending on economic, price and financial data and information available at the time. Ke

www.fxstreet.com

11:00 5월 미국 소매판매 보고서에서 주목해야 할 사항

https://www.forexlive.com/news/preview-what-to-watch-for-in-the-may-us-retail-sales-report-20240617/

Preview: What to watch for in the May US retail sales report | Forexlive

Cracks in the consumer or another win for the spenders

www.forexlive.com

11:00 에너지 시장이 여름 수요 증가를 기대함에 따라 WTI는 배럴당 80달러까지 상승

https://www.fxstreet.com/news/crude-oil-snaps-higher-as-hopes-of-rising-demand-continue-to-bolster-barrel-bids-202406172019

Crude Oil snaps higher as hopes of rising demand continue to bolster barrel bids

WTI climbs to $80 per barrel as energy markets hope for summer demand uptick. Crude Oil markets shrug off disappointment Chinese demand figures. OPEC+ production limits set to expire, could swamp out Crude supplies. West Texas Intermediate (WTI) US Crude O

www.fxstreet.com

16:30 중국은 성장과 에너지 안보를 우선시하면서 석탄 채굴 규제를 완화

https://www.scmp.com/business/commodities/article/3267044/china-seen-easing-coal-mining-curbs-it-prioritises-growth-energy-security-goldman?utm_source=rss_feed

China may ease coal mining curbs as it prioritises growth, energy security

Coal output will grow by 100 million tonnes this year as Beijing loosens restrictions because of economic and energy-security pressures, Goldman says.

www.scmp.com

16:30 유럽 증시는 은행들의 지속적인 회복으로 상승세를 기록

https://www.investing.com/news/economy-news/european-shares-open-higher-as-banks-continue-recovery-3488036

European shares open higher as banks continue recovery By Reuters

European shares open higher as banks continue recovery

www.investing.com

16:30 소매판매 전망과 테슬라의 법적 싸움 등 시장 이슈들

https://www.investing.com/news/economy-news/retail-sales-ahead-teslas-legal-fight-over-musk-pay-deal--whats-moving-markets-3488031

Retail sales ahead, Tesla's legal fight over Musk pay deal - what's moving markets By Investing.com

Retail sales ahead, Tesla's legal fight over Musk pay deal - what's moving markets

www.investing.com

18:00 달러 비관론 속에서 중앙은행들은 올해 더 많은 금을 확보할 것으로 예상

https://www.wsj.com/economy/central-banking/central-banks-expect-to-snap-up-more-gold-this-year-amid-dollar-pessimism-096ce58f

21:30 5월 미국 소매판매

22:15 5월 미국 산업생산

'재테크이야기 > 경제 및 투자 관련 뉴스' 카테고리의 다른 글

| [오늘의 뉴스] 2024년 6월 19일 원자재 뉴스 및 경제 동향 (0) | 2024.06.19 |

|---|---|

| [장시작 소식] 2024년 6월 19일 (0) | 2024.06.19 |

| 2024년 7월 해외선물 옵션 휴장일 안내 (0) | 2024.06.18 |

| [오늘의 뉴스] 2024년 6월 17일 시황, 원자재 및 경제 동향 (0) | 2024.06.17 |

| [오늘의 뉴스] 2024년 6월 14일 시황 및 경제 동향 (0) | 2024.06.14 |

댓글